Full Case Study

Streamlining the Mortgage Application

Project Overview

We conducted a deep dive into friction across both the online Mortgage Application and the Loan Center, with a clear goal: help members move through the process faster, with fewer errors, and more confidence at every step. Our mixed-methods study combined a member survey (n ≈ 100), six 60-minute loan officer interviews, competitive analysis, and end-to-end product walkthroughs.

Across these inputs, we heard consistent themes: confusing language around key milestones (like pre-qualification vs. pre-approval), a step flow that made it easy to get lost or start in the wrong place, limited in-app tools to answer questions in the moment, and weak status and re-entry cues when members returned to finish an application. These insights gave us a clear roadmap for change, helping us prioritize where to simplify copy, restructure the flow, introduce just-in-time guidance, and strengthen progress and status visibility across the experience

Problem

- Bank jargon and unclear CTAs increased cognitive load for first-time buyers.

- Redundant questions and scattered groupings created context switching.

- Lack of calculators and practical tools led to avoidable calls to loan officers.

- Weak re-entry and status visibility caused confusion after breaks/resets.

Goals

- Simplify language and instructions so members proceed with confidence.

- Reduce redundant steps and reorganize questions into an intuitive flow.

- Introduce in-app tools (budget, calculators, agent connect) to enable self-serve.

- Make re-entry obvious and surface status to reduce frustration and support load.

Research Plan & Methods

Survey

Survey Participants≈100 members; 6 Loan Officer Interviews: 60 min sessions comprised of

:• Interview

• Qualitative Study: MDX (Mortgage Application ) & Loan Center,

Interviews

6 × Loan Officers; common pain points, language & flow issues.

Evaluation

Heuristic audit: A comprehensive evaluation process assessing the current user experience.

Key Findings

Keep it simple (Language)

Replacing bank jargon with common language improves comprehension and reduces errors. “We need more common language for the member.” — Loan Officer

- Simplified labels and helper text

- Clear next-step CTAs and instructions

Intuitive flow

Prioritize key questions and group related inputs (e.g., military; assets & liabilities) to cut context switching.

- Remove redundancies; collapse rarely used branches

- Introduce progressive disclosure

In-app tools & calculators

Members need practical tools to self-serve: budgeting, payment, taxes, and agent connection. Reduces avoidable LO calls.

- Collect & connect real-estate agent info

- Budget/payment calculators surfaced contextually

Re-entry & status

Make return paths obvious and show what’s left. Push/email status updates minimize confusion on uploads and reviews.

- Persistent progress & “what’s next”

- Notifications for requests/approvals

Recommendations → Design Directions

Language System

Rewrite jargon; guidance microcopy; examples inline.

Question Architecture

Prioritize, group, and order to match mental models.

Practical Tools

Budget & payment calculators; agent connect workflow.

Re-entry & Status

Findable re-entry, clear status, proactive communication.

Expected Impact

- Higher completion rate via clearer language and flow

- Fewer LO calls due to calculators & guidance

- Less confusion during restarts; better satisfaction

Next Steps

- Prototype problem-solution pairs and run usability tests

- A/B test microcopy changes in MDX

- Define event instrumentation for progress & re-entry

Mortage Application

Task Entry

This screen is the entry point for members who want to purchase a home. They select the “Purchase a home” goal, review key loan details, and begin the guided pre-qualification flow that shapes the rest of the application.

View prototype

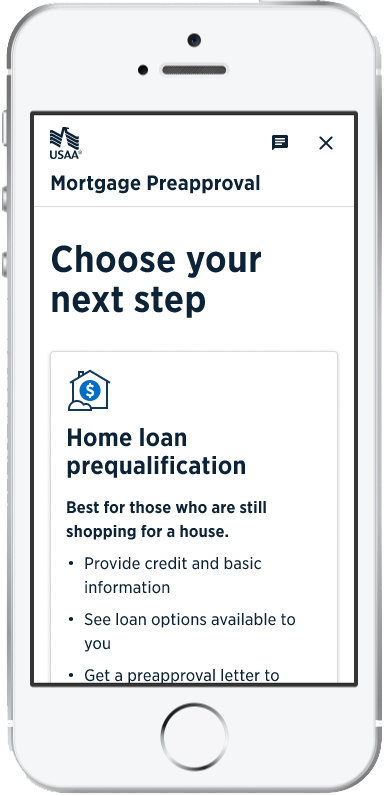

Choose Your Next Step

This screen is a task-entry hub for Mortgage Preapproval, guiding members to the right next step with scannable option cards (Prequalification, Mortgage Application, Refinance). Each card includes a “Best for…” line, quick expectation-setting bullets, and a clear CTA to route members into the correct flow. A “Not ready to start?” fallback with a call option helps reduce drop-offs, while the consistent header and card layout makes options easy to compare and navigate.

View prototype

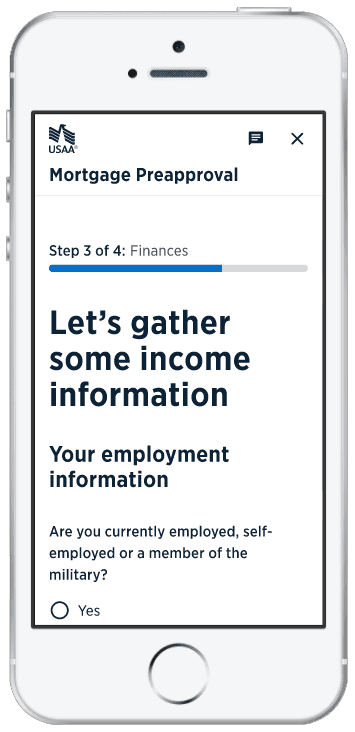

Gather Income Information

This screen collects income details in Step 3 of 4 (Finances) by splitting the task into clear sections: employment status first, then “other current income,” with guidance to prevent rental income from being entered in the wrong place. It reduces friction with simple yes/no radios, supports different situations through an income-type dropdown, monthly amount field, and an “Add income source” action, and includes a disclosure panel for sensitive income types (like alimony/child support). Persistent Next/Previous buttons and the progress indicator keep users oriented and moving forward.

View prototype